Dwola Payments Guide: ACH Infrastructure, Business Workflows & API Integration

Introduction

Bank-to-bank transfer systems are widely used in the United States for recurring billing, vendor payouts, subscription payments, and internal fund movements. ACH-based infrastructure allows businesses to automate these processes without relying exclusively on card networks.

Dwola is frequently referenced in discussions about API-driven ACH payments. This article provides a structured, neutral explanation of dwola, including platform capabilities, integration considerations, and compliance factors. The information is for research and educational purposes only.

What Is Dwola?

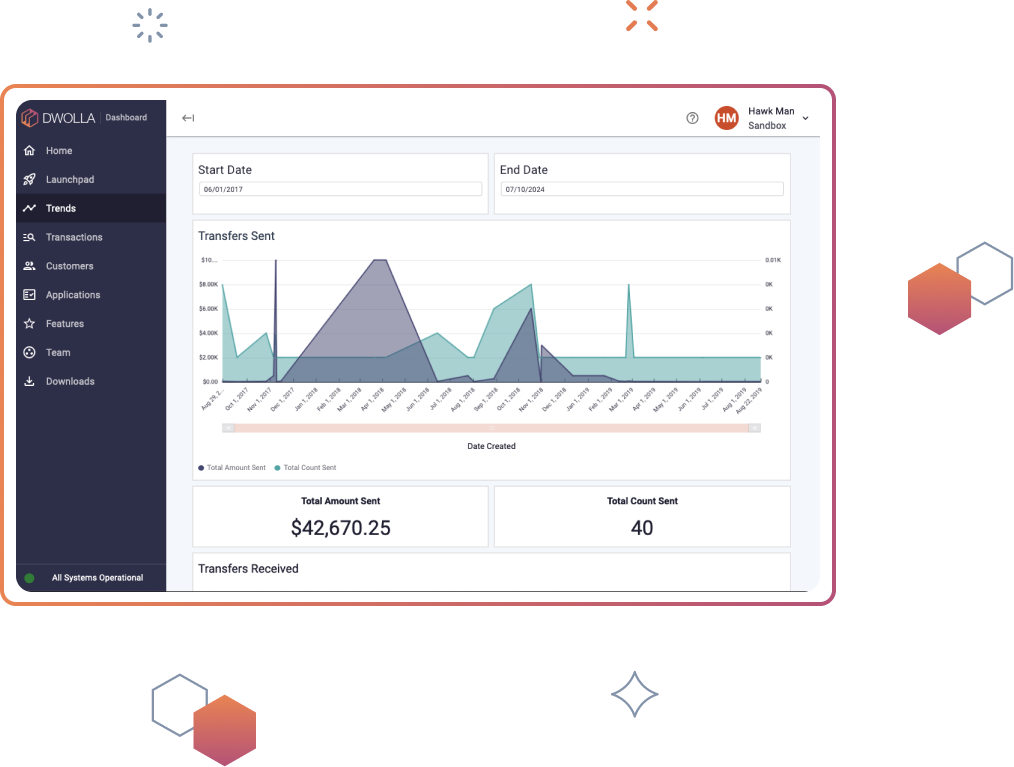

Dwolla is a U.S.-based financial technology provider offering ACH payment infrastructure through an API-first approach. Rather than operating as a consumer-facing payment wallet, dwola enables businesses to embed direct bank transfer capabilities within their own platforms.

The primary function centers on facilitating account-to-account transfers via ACH rails.

Platform Architecture & Technical Design

4

Dwola’s infrastructure typically includes:

- REST-based API endpoints

- Webhook notifications for transaction updates

- OAuth or token-based authentication

- Sandbox testing environments

This structure allows developers to programmatically initiate, monitor, and manage ACH transfers.

Core Functional Capabilities

Dwola may support:

ACH Transfers

Bank-to-bank transfers using automated clearing house rails.

Recurring Payment Automation

Subscription-based or scheduled billing workflows.

Mass Payout Distribution

Bulk disbursement capabilities for marketplaces or gig platforms.

Bank Account Verification

Ownership verification processes prior to initiating transfers.

Business Use Cases

Dwola infrastructure may be integrated into:

- SaaS subscription platforms

- Digital marketplaces

- Fintech applications

- Payroll-related service providers

- B2B payment automation systems

Actual implementation depends on transaction volume, regulatory scope, and technical requirements.

Compliance & Regulatory Considerations

ACH payment systems operate within a regulated framework. Businesses evaluating dwola should review:

- KYC (Know Your Customer) procedures

- AML (Anti-Money Laundering) controls

- NACHA compliance standards

- Data encryption practices

- Partner financial institution arrangements

Legal and compliance review is recommended before production deployment.

Security Framework

Dwola generally implements security measures such as:

- Encrypted data transmission

- Token-based API authentication

- Role-based access controls

- Activity monitoring systems

Security policies should align with organizational risk management standards.

Integration Workflow Overview

Businesses integrating dwola typically follow these steps:

- Create developer credentials.

- Use sandbox mode for testing.

- Build API calls for transfer initiation.

- Configure webhook listeners.

- Complete compliance onboarding.

- Transition to live production environment.

Thorough testing reduces operational and settlement risks.

Dwola vs Card Network Payment Systems

| Feature | Card Processors | Dwola |

|---|---|---|

| Card Network Dependency | Yes | No |

| ACH Transfers | Limited | Core capability |

| API-First Integration | Varies | Yes |

| Recurring Bank Billing | Possible | Supported |

| Direct Bank Transfers | Partial | Primary focus |

Dwola’s infrastructure is optimized for ACH-based payment models rather than card-based transactions.

Operational & Risk Considerations

Before adopting dwola, organizations should evaluate:

- Settlement timelines

- Return and reversal policies

- Fraud prevention controls

- Transaction volume requirements

- Technical resource availability

Structured implementation planning is essential for payment system stability.

Conclusion

Dwola provides ACH-based payment infrastructure through a developer-focused API model. Businesses seeking direct bank transfer capabilities may evaluate dwola as part of broader payment strategy discussions. Regulatory compliance, technical integration, and operational readiness should be assessed before implementation.

This content is informational and does not constitute financial or legal advice.