Dwola Payment Infrastructure Guide: API Capabilities, ACH Transfers & Business Integration

Introduction

Modern businesses increasingly rely on API-driven financial infrastructure to automate transfers, manage payouts, and streamline account-to-account transactions. Platforms built around bank transfer rails have become essential for fintech products, marketplaces, and SaaS companies.

Dwola is commonly referenced in discussions around ACH-based payment systems and embedded financial services. This article provides an informational overview of dwola, its infrastructure model, and considerations for businesses evaluating payment APIs.

This content is educational and does not constitute financial or legal advice.

What Is Dwola?

Dwolla is a U.S.-based financial technology company that provides ACH payment infrastructure through API integration. The platform is designed to enable businesses to move funds between bank accounts programmatically.

Dwola focuses on account-to-account (A2A) transfers rather than card-based payment networks.

Platform Infrastructure & API Model

4

Dwola operates primarily through an API-first model. Businesses integrate its infrastructure into their applications to support:

- ACH bank transfers

- Recurring payments

- Mass payouts

- Account verification processes

- Webhook notifications for transaction updates

The API-based structure allows customization within enterprise workflows.

Core Capabilities

Dwola’s infrastructure typically supports:

1. ACH Transfers

Businesses can initiate transfers between verified bank accounts using automated clearing house (ACH) rails.

2. Embedded Payments

Developers may integrate dwola’s API into SaaS platforms, marketplaces, or fintech applications.

3. Fund Verification

The platform supports bank account verification methods to help confirm account ownership.

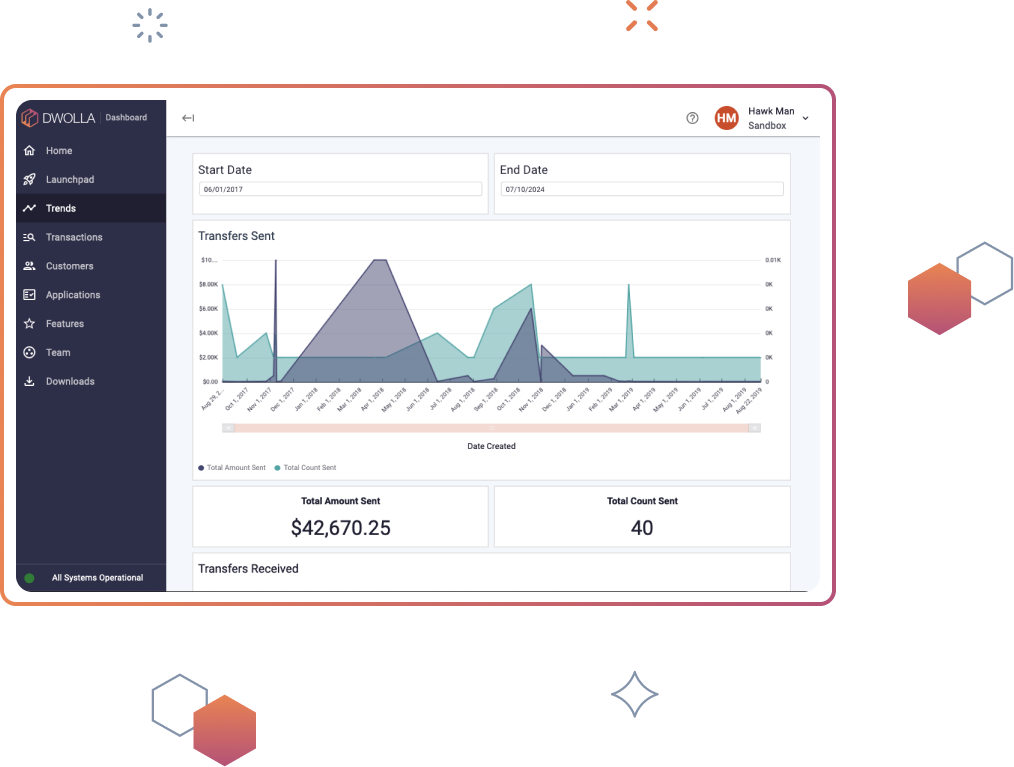

4. Payment Status Tracking

Webhooks and reporting tools provide visibility into transaction states.

Use Cases

Dwola infrastructure may be used by:

- SaaS platforms facilitating recurring billing

- Marketplaces managing vendor payouts

- Financial service providers moving funds between users

- Platforms requiring direct bank transfer capabilities

Each business use case depends on regulatory and operational requirements.

Compliance & Regulatory Considerations

Financial infrastructure providers operate within strict regulatory environments. Businesses evaluating dwola should review:

- KYC (Know Your Customer) requirements

- AML (Anti-Money Laundering) controls

- Data encryption standards

- NACHA compliance guidelines

- Partner banking arrangements

Legal and compliance teams should assess documentation before implementation.

Security Standards

Dwola generally incorporates security measures such as:

- Encrypted API communications

- Token-based authentication

- Role-based access control

- Monitoring systems for suspicious activity

Security practices should be evaluated according to business risk tolerance.

Integration & Developer Environment

Dwola provides:

- Developer documentation

- Sandbox environments

- API reference guides

- Testing tools for integration

Proper implementation requires technical resources familiar with payment APIs and ACH workflows.

Dwola vs Card-Based Payment Processors

| Feature | Card Processors | Dwola |

|---|---|---|

| Card Network Usage | Yes | No |

| ACH Transfers | Sometimes | Core focus |

| API-First Design | Varies | Yes |

| Recurring Bank Transfers | Limited | Supported |

| Transaction Fees | Card-based structure | ACH-based model |

Dwola’s focus on ACH transfers may appeal to businesses seeking direct bank-to-bank payment rails.

Implementation Considerations

Before integrating dwola, businesses should:

- Define transaction volume requirements.

- Review compliance obligations.

- Evaluate integration complexity.

- Assess banking partnerships.

- Conduct sandbox testing before production deployment.

Structured planning reduces operational risk.

Conclusion

Dwola is a fintech infrastructure provider offering ACH-based payment APIs for businesses seeking direct bank transfer capabilities. Organizations evaluating dwola should carefully review regulatory documentation, security standards, and integration requirements before implementation.

This article is provided for informational purposes only and does not constitute financial or legal advice.