Dwola ACH Platform Review: Payment Automation, API Controls & Business Compliance

Introduction

ACH-based payment systems remain a core component of U.S. financial infrastructure. Many businesses use automated clearing house rails for subscription billing, vendor payouts, and bank-to-bank transfers. API-driven platforms have made it possible to embed these payment capabilities directly into digital products.

Dwola is frequently mentioned in discussions about ACH payment APIs and embedded financial infrastructure. This article provides a neutral, structured overview of dwola, its technical framework, and compliance considerations. The information is educational and does not constitute financial or legal advice.

What Is Dwola?

Dwolla is a financial technology provider offering ACH-based transfer capabilities through a developer-focused API model. Instead of operating as a consumer wallet, dwola enables businesses to integrate bank transfer functionality into their own platforms.

Its primary focus is facilitating direct account-to-account transfers via ACH rails.

Technical Architecture & API Framework

4

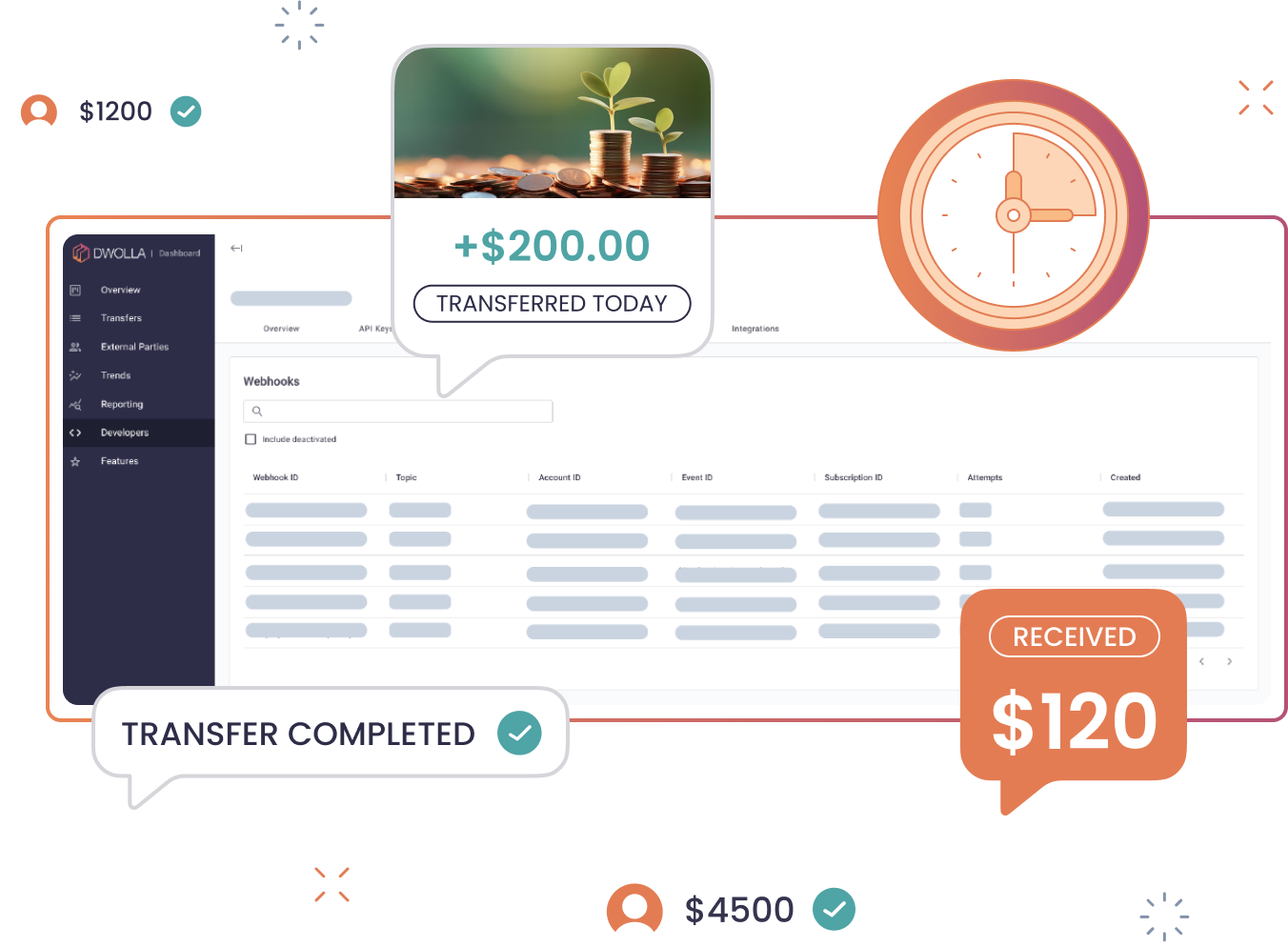

Dwola’s infrastructure generally includes:

- REST-based API endpoints

- Secure authentication tokens

- Webhook notifications for real-time updates

- Sandbox testing tools for developers

This design allows businesses to automate payment flows within custom applications.

Core Functional Capabilities

Dwola may support the following features:

ACH Bank Transfers

Direct transfers between verified U.S. bank accounts.

Recurring Payment Automation

Subscription and scheduled payment workflows.

Bulk or Mass Payouts

Distribution of funds to multiple recipients.

Bank Account Verification

Processes to confirm account ownership before initiating transfers.

Business Applications

Dwola infrastructure may be used in:

- SaaS subscription billing systems

- Online marketplaces managing payouts

- Fintech applications moving user funds

- B2B invoicing automation

- Platform-based service providers

Actual usage depends on transaction volume, regulatory scope, and technical implementation.

Compliance & Regulatory Framework

ACH payment systems operate under defined regulatory standards. Organizations evaluating dwola should assess:

- KYC (Know Your Customer) policies

- AML (Anti-Money Laundering) controls

- NACHA operating rules

- Data security requirements

- Partner banking arrangements

Legal and compliance teams should review documentation prior to integration.

Security Practices

Dwola generally incorporates security measures such as:

- Encrypted API communication

- Token-based authentication

- Role-based access permissions

- Monitoring for irregular activity

Security frameworks should align with organizational risk management standards.

Integration Workflow

A typical dwola integration process may include:

- Registering for developer access

- Generating API credentials

- Building sandbox test flows

- Configuring webhook listeners

- Completing compliance onboarding

- Deploying to production

Thorough testing is recommended before handling live transactions.

Dwola Compared to Card-Based Payment Systems

| Feature | Card-Based Processors | Dwola |

|---|---|---|

| Card Network Usage | Yes | No |

| ACH Focus | Limited | Primary capability |

| API-First Model | Varies | Yes |

| Recurring Bank Transfers | Possible | Supported |

| Direct Account-to-Account Transfers | Partial | Core feature |

Dwola’s focus on ACH rails differentiates it from card-dependent processors.

Operational Considerations

Before implementing dwola, businesses should evaluate:

- Settlement timeframes

- Return handling processes

- Fraud prevention controls

- Technical resource requirements

- Compliance obligations

Careful planning reduces operational risk and improves reliability.

Conclusion

Dwola provides ACH-based payment infrastructure through a developer-oriented API framework. Businesses seeking embedded bank transfer functionality may consider dwola as part of a broader payment strategy evaluation. Compliance review, technical testing, and operational readiness are essential prior to deployment.

This article is for informational purposes only and does not constitute financial or legal advice.